Pimco feels central bank out of policies in the event of a recession

The timeline for the recession of United States has been pushed out though the experts at the giant Pimco have been saying that the synchronized easing of the monetary policy by the central banks globally are an important force for the stabilization of the growth rates in the year have already been utilized leaving the policymakers a little handicapped in the event of the next recession taking place.

In their outlook for the upcoming year they have written that whenever there is a major risk to the markets or another economic downturn, the policymakers will be having lesser capacity for the maneuvering of the ability to limit their ability of fighting the recessionary forces in future.

The Central Bank of Europe, Federal Reserve and the other institutions which are equivalent to this all across the world had lowered their rates of interest or engaged in the purchases of assets in the previous year trying to limit worst of the slowdown in the economy globally being driven by the US and China trade war. With the signing of the phase one deal imminent between these two countries a lot of the analysts are saying that the growth rates apart from United States might be beginning to get steady.

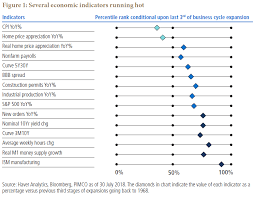

Though with the economy of the United States being in their 11th consecutive year of expansion, a lot of the economist fear that the lowing of interest rates may have reduced the firepower which had been available to the central banks.

The insiders of the Central Bank have been in disagreement as they feel they are capable whenever the downturn comes of handling it and have argued that they have a lot of policy measures which can be exercised.